In the ever-evolving world of finance, maintaining a well-balanced investment portfolio is crucial for achieving long-term success. One of the most effective tools at your disposal is a portfolio rebalance calculator, designed to help you assess your investments and adjust your asset allocation based on your financial goals and market conditions. By utilizing such a calculator, investors can make informed decisions about when and how to rebalance their portfolios, ensuring they stay on track to meet their financial objectives.

Investing can often feel like navigating a labyrinth with numerous twists and turns. The portfolio rebalance calculator acts as a guiding light, providing you with clear insights into your asset distribution. Whether you're a seasoned investor or just starting out, understanding how to rebalance your portfolio is essential for minimizing risks and optimizing returns. This article will delve into the complexities of portfolio management, answering important questions and offering practical advice to help you harness the power of a portfolio rebalance calculator.

As we explore the intricacies of this financial tool, we will cover essential topics such as the importance of rebalancing, the steps involved in the process, and how a portfolio rebalance calculator can simplify your investment journey. With the right knowledge and resources, you can take charge of your financial future and work towards achieving your dreams with confidence.

What is a Portfolio Rebalance Calculator?

A portfolio rebalance calculator is a specialized tool designed to assist investors in adjusting their asset allocation based on predefined investment goals and risk tolerance. It helps in maintaining the desired level of diversification by providing insights into how much to sell or buy within specific asset classes. By regularly rebalancing your portfolio, you can avoid overexposure to certain investments that may have outperformed or underperformed relative to your overall strategy.

Why is Rebalancing Important?

Rebalancing your portfolio is essential for several reasons:

- Maintaining desired risk levels: Asset prices fluctuate over time, which can lead to an imbalance in your desired risk exposure.

- Maximizing returns: Regular rebalancing can help capture gains from outperforming assets while reinvesting in underperforming ones.

- Staying aligned with financial goals: As your personal circumstances or market conditions change, rebalancing ensures your portfolio remains aligned with your financial objectives.

How Does a Portfolio Rebalance Calculator Work?

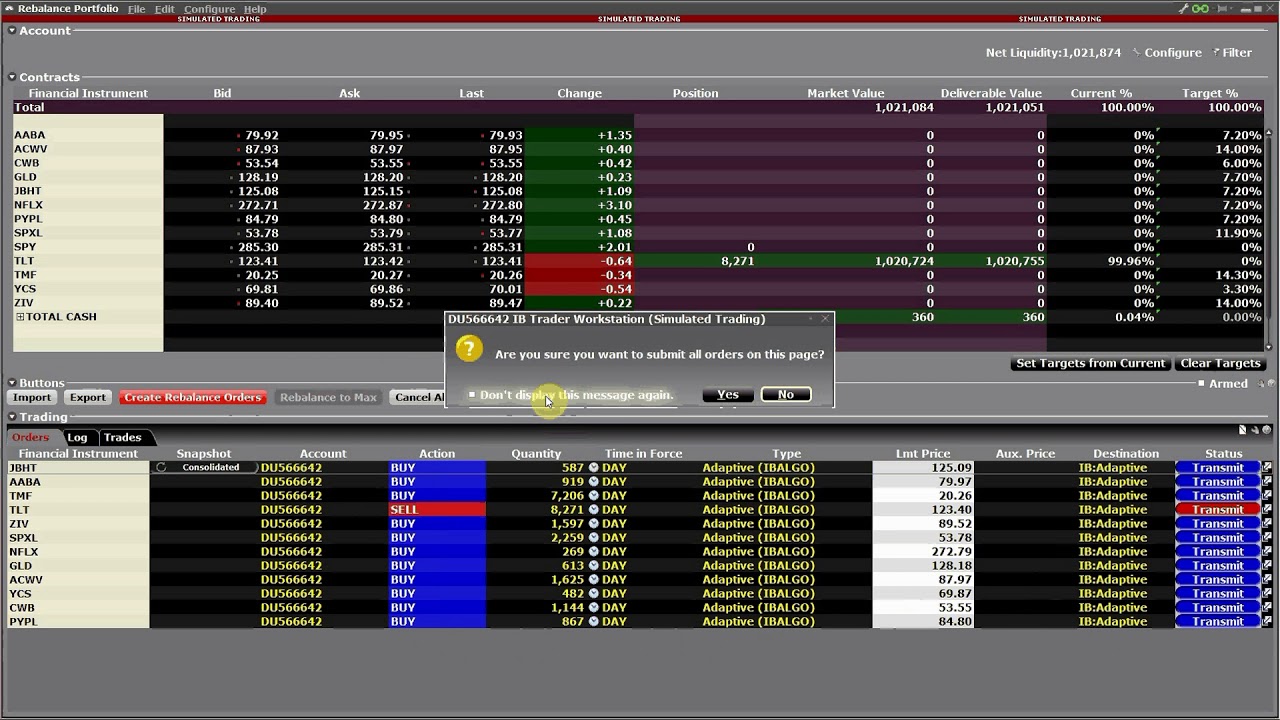

The functionality of a portfolio rebalance calculator is relatively straightforward. Here’s a step-by-step breakdown of how it typically works:

- Input your current portfolio allocations: Enter the percentage of each asset class in your investment portfolio.

- Set target allocations: Define your ideal asset distribution based on your risk tolerance and investment goals.

- Analyze results: The calculator will provide recommendations on how much to buy or sell in each asset class to achieve your target allocations.

When Should You Use a Portfolio Rebalance Calculator?

Determining the right time to use a portfolio rebalance calculator can greatly impact your investment success. Common scenarios include:

- After significant market movements: Major fluctuations can alter your asset allocation, prompting the need for rebalancing.

- At regular intervals: Consider rebalancing every six months or annually to ensure your portfolio remains aligned with your goals.

- Upon life changes: Events such as marriage, retirement, or career changes may necessitate a review of your financial objectives.

What Are the Benefits of Using a Portfolio Rebalance Calculator?

Utilizing a portfolio rebalance calculator offers several advantages:

- Simplicity: Calculators provide a straightforward method to assess and adjust your portfolio without complex calculations.

- Objectivity: The calculator's recommendations are based on data, reducing emotional decision-making in your investment strategy.

- Time-saving: It streamlines the rebalancing process, allowing you to focus on other important aspects of your financial planning.

Are There Any Limitations to a Portfolio Rebalance Calculator?

While a portfolio rebalance calculator is a valuable tool, it does have some limitations to consider:

- Market timing: The calculator provides recommendations based on current data but does not account for future market movements.

- Assumptions: The effectiveness of the calculator depends on the accuracy of the inputs you provide regarding your goals and risk tolerance.

- Fees and taxes: Rebalancing can incur transaction costs and tax implications that may impact your overall returns.

How Can You Choose the Right Portfolio Rebalance Calculator?

Selecting the right portfolio rebalance calculator is crucial for effective portfolio management. Consider the following factors:

- User-friendly interface: Look for calculators that are easy to navigate and understand.

- Comprehensive features: Opt for tools that offer detailed analysis, including tax implications and transaction costs.

- Reputation: Research reviews and testimonials to ensure the calculator is reputable and reliable.

Can You Build Your Own Portfolio Rebalance Calculator?

Yes, creating your own portfolio rebalance calculator is possible if you have a basic understanding of spreadsheet software. Here’s how:

- Set up your asset categories: Create columns for each asset class in your portfolio.

- Input current allocations: Enter the current percentage holdings for each category.

- Define target allocations: Specify your desired allocations for each asset class.

- Calculate differences: Use formulas to determine how much to buy or sell to achieve your targets.

Conclusion: Empower Your Investment Journey with a Portfolio Rebalance Calculator

In conclusion, a portfolio rebalance calculator is an invaluable tool that can help you maintain a well-balanced investment strategy. By understanding its purpose, benefits, and limitations, you can make informed decisions that align with your financial goals. Whether you’re a novice investor or an experienced trader, utilizing this calculator can lead to better investment outcomes and greater financial success.

Article Recommendations

- The Ultimate Guide To Why Fletcher Cut His Hair

- Mitch Mcconnell 2021 Election Results Amp Impact

- Uncover The Enchanting World Of Saleta Losada Your Guide To Exquisite Pieces